Blog

The impacts of 25% US tariffs on the Canadian cattle and beef industry

Sebastien Pouliot, Ph.D.Series: Agriculture

So far, Canadian exports of cattle and beef to the United States have been exempt from tariffs. Who knows if that will be true in a month, or even tomorrow?

In this blog post, I examine the impacts of US tariffs on the Canadian cattle and beef industry. The United States is the most important destination for Canadian cattle and beef and tariffs would have major impacts on the Canadian beef industry.

Canadian exports of cattle and beef

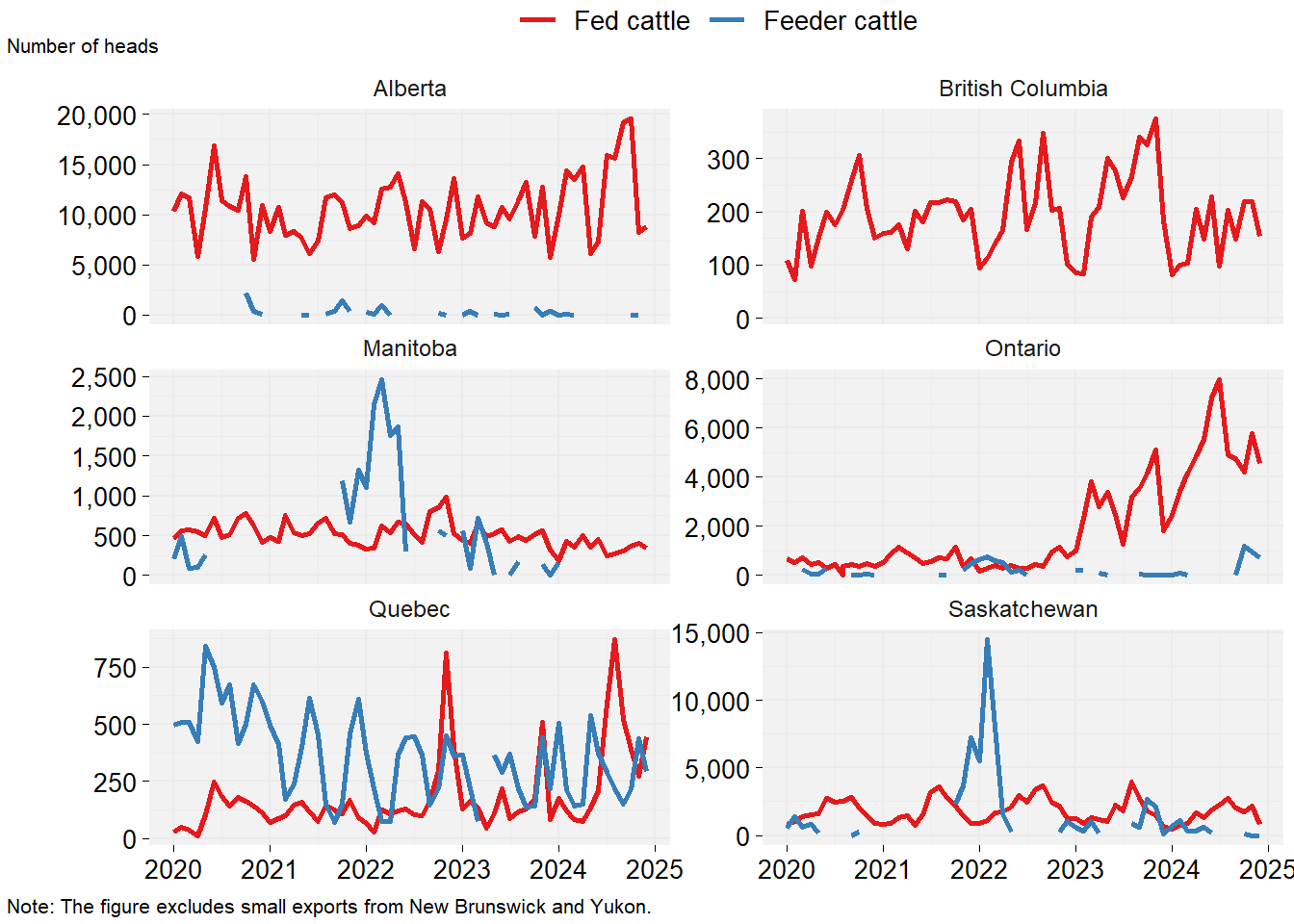

Canada exports feeder cattle (young cattle going to feedlots) and fed cattle (about 18 months old cattle ready for slaughter) almost exclusively to the United States. Figure 1 shows monthly Canadian cattle exports to the United States since 2020. Exports of feeder cattle are small compared to the exports of fed cattle. Alberta exports the most fed cattle, on average, about 12,776 per month in 2024. Quebec is the largest exporter of feeder cattle. Saskatchewan and Manitoba exports of feeder cattle surged in late 2021 and early 2022 following the 2021 drought in the Prairies.

Figure 1: Monthly Canadian cattle exports to the United States

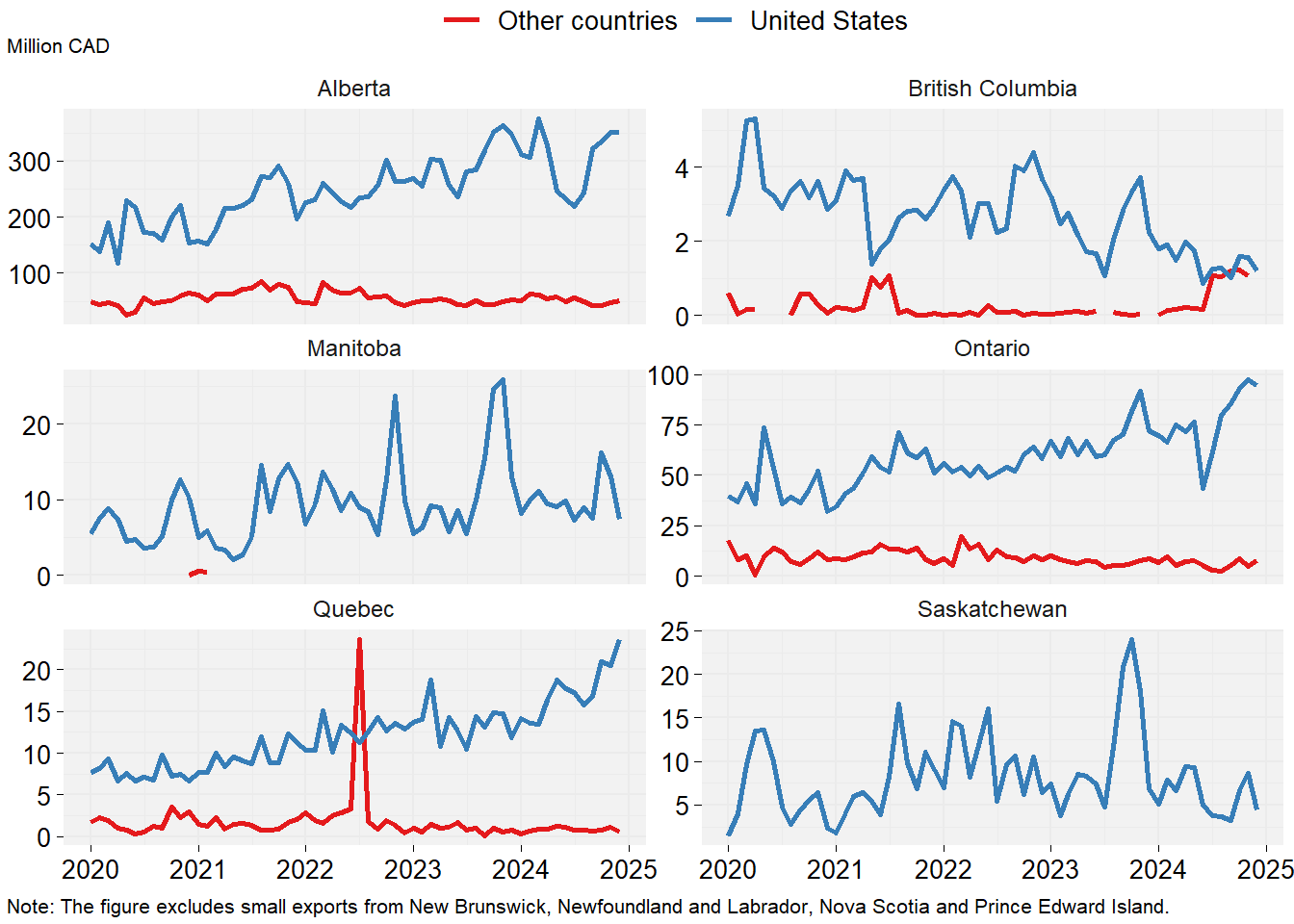

Figure 2 shows monthly Canadian exports of beef to the United States and to other countries. Alberta is by far the largest beef exporter with exports exceeding CAD 4.2 billion in 2024. Ontario follows with CAD 988 million. In 2024, 87% of beef exports were to the United States.

Figure 2: Monthly Canadian beef exports

Estimates of the economic impacts

Like my previous post on the impact of US tariffs on the Canadian hog and pork industry, I use an equilibrium displacement model. This type of model has been used before to study livestock and meat trade between Canada and the United States (see for example, Brester, Marsh and Atwood (2004), Pendell, Brester, Schroeder, Dhuyvetter and Tonsor (2010) or Hahn, Sydow and Preston (2019)).

I model the supply chains in Canada and the United States. In the model, Canada exports feeder cattle, fed cattle and beef to the United States, and exports beef to other countries. The United States imports feeder cattle from Canada and Mexico, and fed cattle and beef from Canada. In practice, beef trade between Canada and the United States flows two ways, with Canada being a net beef exporter to the United States. The objective of the model is to capture the net flow of beef to the United States. I do not consider the impacts of tariffs on feed costs and on the costs for other inputs.

The model is calibrated to 2024 data except for beef consumption in Canada, for which the latest data available is for 2023. Calibration to 2024 data means that the model takes the economic conditions observed in 2024 and then examines the impact of 25% tariffs on US imports of feeder cattle, fed cattle and beef, everything else remaining the same. The length of run of the model is a year, meaning that the results are for the impacts of the tariffs a year after they are introduced, hence giving time to markets to adjust.

The results cannot be interpreted as a prediction of what would happen if tariffs were applied in 2025, but rather as a counterfactual exercise of the impact of tariffs for 2024. The economic conditions in 2025 are different than those in 2024; notably, the Canadian dollar is weaker. Nonetheless, the model gives a good idea of the size of the economic impacts that can be expected in 2025.

Table 1 shows the impacts on the Canadian cattle and beef industry of 25% tariffs on all US imports of cattle and beef from Canada and Mexico. The model finds a small impact on export volume of feeder cattle to the United States, although prices for feeder cattle in Canada decline by 16.5%. Total production of fed cattle in Canada declines by 2.5%, exports of fed cattle decrease by 18.6% and the price of fed cattle is 22.6% lower because of the tariffs. The tariffs cause retail beef prices in Canada to decline by 22.7%, which yields a 13.6% increase in beef consumption in Canada. Exports of beef to the United States drop by 46.6% but are partially replaced by a 46% increase in exports to other countries.

The economic impacts of the 25% tariffs on the Canadian cattle and beef sector are substantial. Total farm cash receipts for feeder and fed cattle declines by CAD 4.02 billion. The value of feeder cattle exports declines by CAD 46 million and the value of fed cattle exports drops by CAD 806 million. The value of beef consumption in Canada declines by CAD 1.14 because the increase in consumption volume does not fully compensate for the price drop. The value of beef exports to the US declines by CAD 2.04 billion, whiles value of beef exports to other countries increases by CAD 90 million.

Other considerations

As discussed in my previous post for hogs and pork, my model does not consider the effect of variations in Canada-US exchange rate. Currently, the average Canada-US exchange rate for 2025 is 4.4% lower than in the average for 2024. A lower exchange rate diminishes the impacts of the tariffs. With a 4.4% lower exchange, a 25% tariff becomes equivalent to 20.6% tariff.

The tariff war impacts markets in various ways. The model does not consider the impacts of tariffs on feed and other input costs and the impacts of retaliatory tariffs by Canada and other countries. It is possible that the tariff war causes lower production costs for cattle and beef in Canada and that foreign markets open to Canadian beef because of retaliatory tariffs on US beef, hence lowering the impacts estimated in this blog post.