Blog

Forecasts of Quebec farm gate milk prices

Sebastien Pouliot, Ph.D.Series: Agriculture

One objective of supply management in the Canadian dairy sector is to “Guarantee producers a stable and equitable income derived entirely from the marketplace.” This does not make farm gate milk prices entirely predictable and stable. Indeed, monthly price variations are not negligible and can significantly affect dairy farms profitability.

In this post I forecast farm gate milk prices in Quebec and find that economic conditions do not favour significant price growth in 2024. My models forecast a 0.8% increase in Quebec farm gate milk prices in 2024 compared to 2023.

Where do farm gate milk prices come from?

Before discussing the forecasts, let me offer discuss briefly how farm gate milk prices are derived. I’ll simplify the description of the system, perhaps some will say oversimplify, and I’ll focus on farms and processors.

Farmers sell raw milk to processors who manufacture from it consumer products or ingredients for further processing. Milk is assigned a class depending on its end use:

- Class 1: Fluid milk and beverages;

- Class 2: Yogurts, sports milk drinks, ice cream, etc.;

- Class 3: Cheese;

- Class 4: Butter, butteroil and dairy product for the food industry (e.g., milk powders);

- Class 5: Dairy products used as an ingredient in the further processing sector.

Processors value milk components: butterfat, proteins, and other solids. It is the quantities of components in kilograms that are billed rather than the volume of milk in litres. Prices for the milk components across classes are set by the Canadian Dairy Commission (CDC): see the prices here and here. For class 4A, following agreed upon rule in the Canada-United States-Mexico Agreement (CUSMA), prices for proteins and other solids are set monthly based on the USDA nonfat dry milk price. The CDC buys and sells butter at a support price which stabilizes seasonal variations in the production and the demand for butterfat.

Revenues from the sales of raw milk are pooled and provincial boards derive from them farm prices for butterfat, proteins and other solids. Farm prices for the components do not equal their average values when sold to processors. Farm prices reward the production of butterfat relative to the sum of proteins and other solids. The table below shows the Quebec farm gate prices for December 2023. The volume of milk going to level 1 or level 2 depends on the ratio of the sum of proteins and other solids over butterfat and as such it is not possible to calculate the average value based on the average composition. Below, my objective will be to forecast the average value, which was $98.28/hl in December 2023.

| Butterfat ($/kg) | Proteins ($/kg) | Other solids ($/kg) | Value at avg. composition ($/hl) | |

|---|---|---|---|---|

| Level 1 within quota price | 13.6231 | 10.3453 | 0.90 | 98.2800 |

| Level 2 within quota price | 1.8263 | 0.63 | ||

| PLQ quality premium | 0.5000 | |||

| CMML quality premium | 0.1871 |

| Avg. composition (kg/hl) | |

|---|---|

| Butterfat | 4.3895 |

| Proteins | 3.3606 |

| Other solids | 5.9151 |

| Fees | |

|---|---|

| Administration | 0.0432 ($/kg) |

| Advertising | 0.1007 ($/kg) |

| Development funds | 0.0008 ($/kg) |

| Transportation | 3.4521 ($/hl) |

The forecasts

I wrote more than a year ago about the trends affecting the Canadian dairy industry. These trends are still relevant today and the models I developed account for them.

For my forecasts of Quebec farm gate milk price, I assume the following:

- No adjustment to milk prices and to the support price for butter in 2024 other than what will take into effect on May 1st;

- GDP grows by 1% in 2024 as forecasted by the Bank of Canada in its latest Monetary Policy Report.

- The exchange rate stays constant at the latest value observed at the time of the forecasts.

- The USDA nonfat dry milk price follows the futures forward curve.

- Total milk volumes and component concentrations follow their recent trends and their typical seasonal patterns.

- The butter stock-to-use ratio follows typical seasonal patterns.

Regarding the total raw milk volumes, the model predicts a 1.6% increase for the P5 (Ontario, Quebec, New Brunswick, Nova Scotia and Prince Edward Island) provinces in 2024.

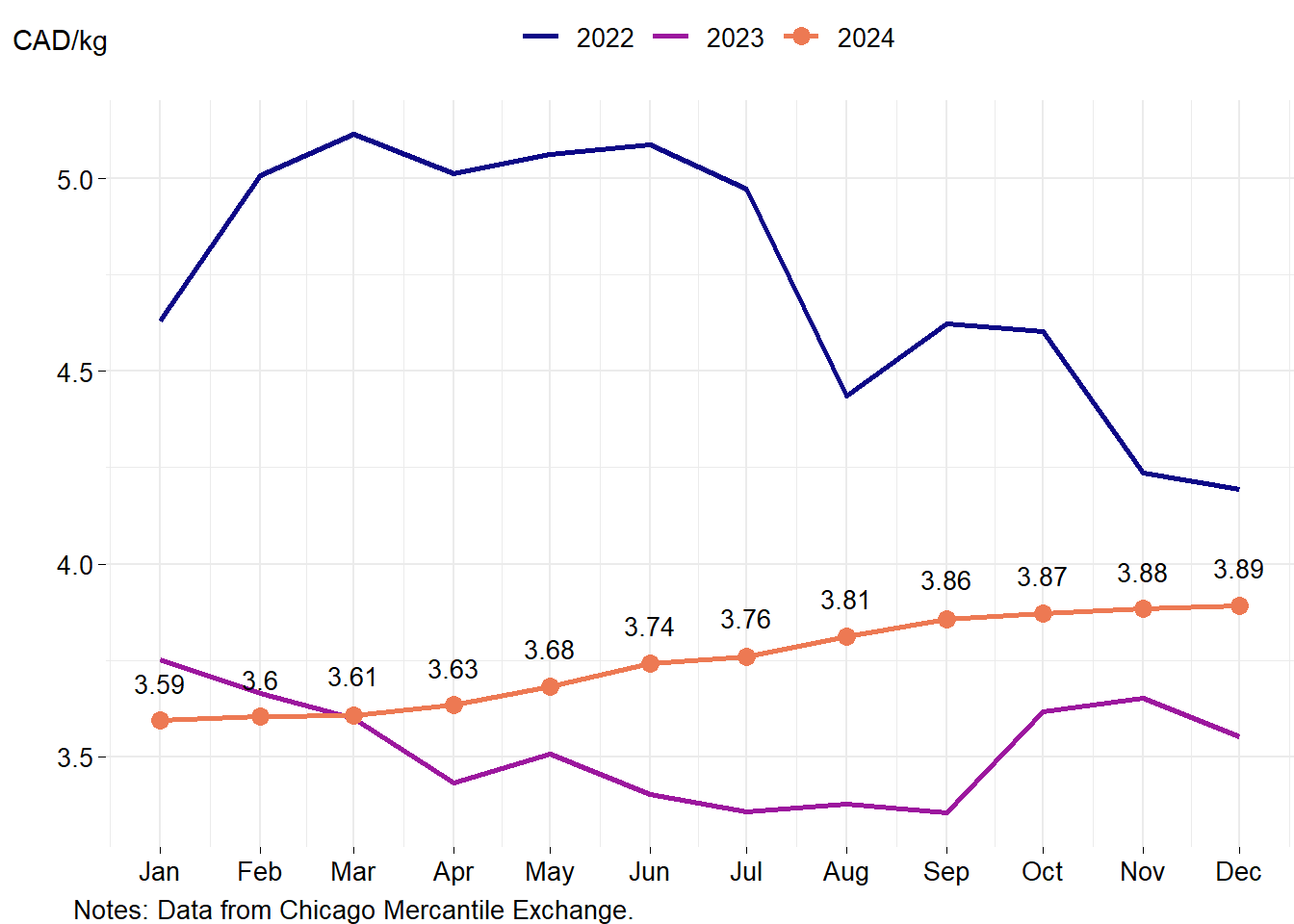

Figure 1 shows the USDA nonfat dry milk price converted into CAD per kilogram. From the futures forward curve, we can expect a higher price for USDA nonfat dry milk in 2024 compared to 2023 but lower than in 2022. This will support a slightly higher price for class 4A, which includes skim milk powder.

Figure 1: Nonfat dry milk futures price

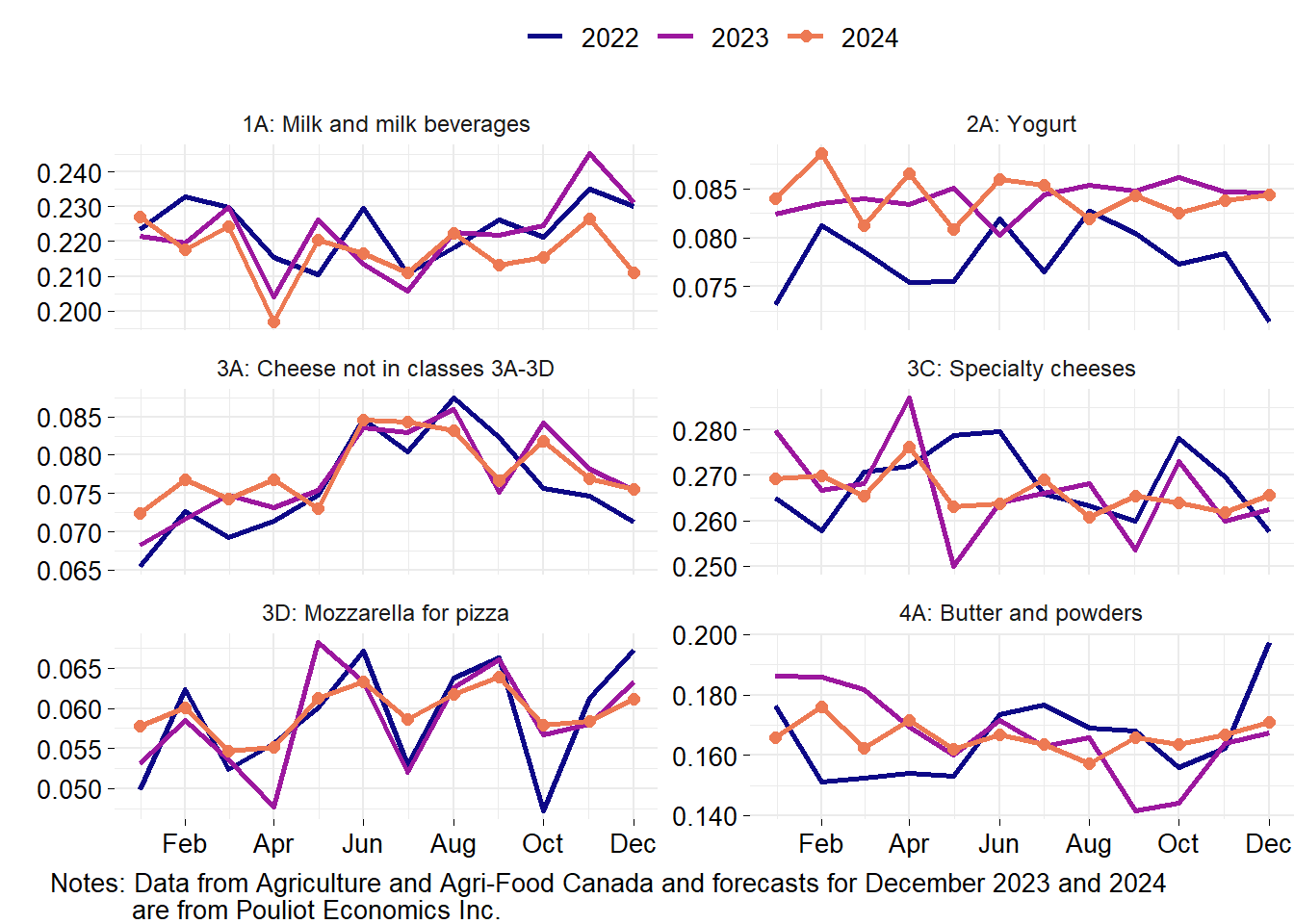

Figure 2 shows raw milk volume shares for selected milk classes. The model does not forecast large changes in the distribution of milk across classes in 2024 compared to 2023 except for a smaller share of milk going into class 1A in the last quarter of 2024. This will have a negative impact on farm gate prices as we will see below.

Figure 2: Raw milk volume shares for selected classes

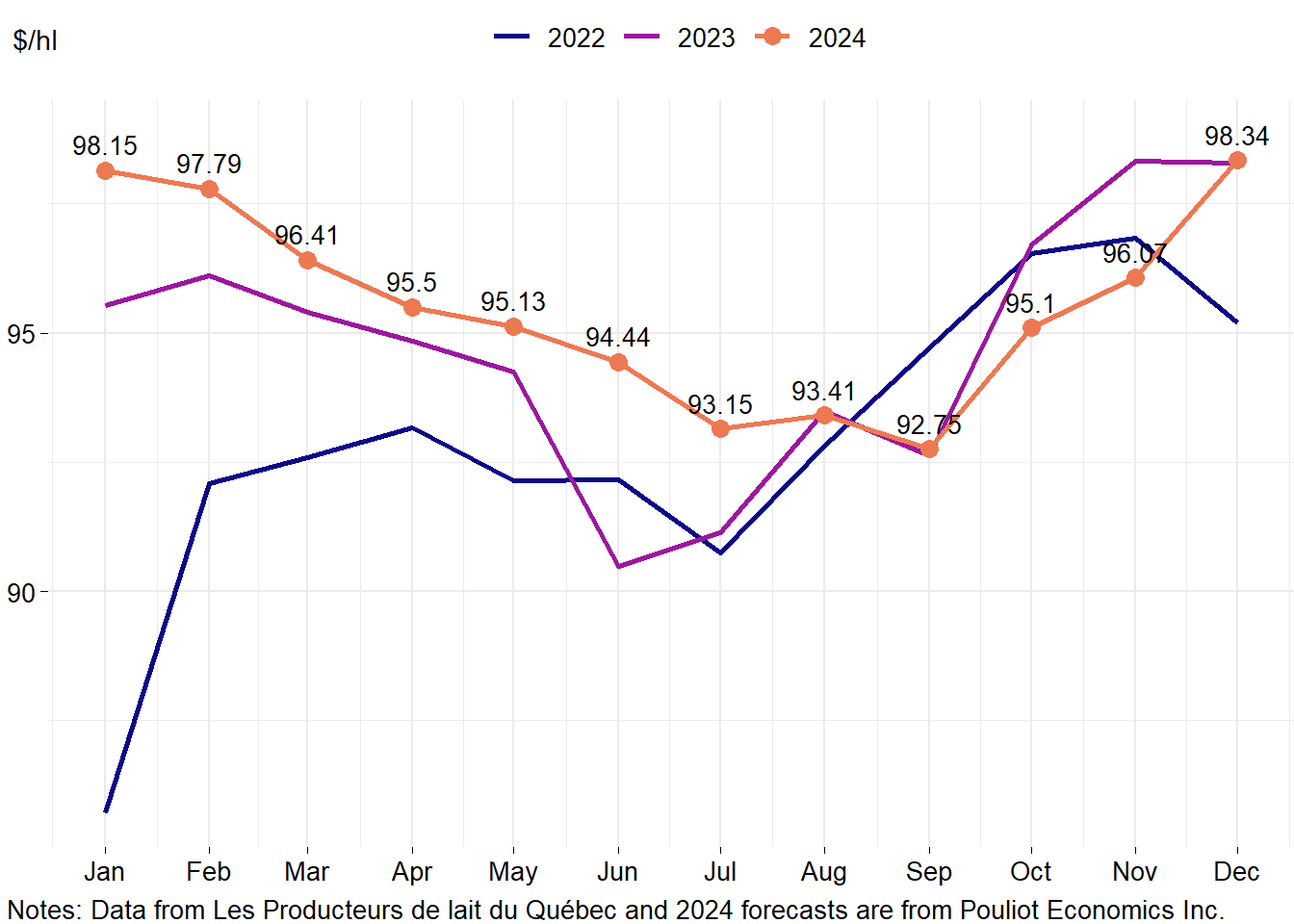

Figure 3 shows Quebec average farm gate prices for 2022, 2023, and forecasts for 2024. For 2024, farm gate milk prices in Quebec should increase by 0.8% compared 2023, representing $0.007/litre. The model finds higher prices for the first 8 months of 2024 compared to 2023, but slightly lower prices in the months afterwards because of a smaller share milk forecasted to flow into class 1A in the last quarter of 2024 (see Figure 2).

The main takeaway is that economic conditions do not support a significant increase of farm gate milk prices in Quebec in 2024. The May 2024 adjustment to the farm gate price of milk will contribute to slightly higher prices but not enough to counter the impact of smaller volumes going into class 1A in the fourth quarter.

Figure 3: Forecast of Quebec farm gate milk price

What else?

I did not touch on several issues that impact farm gate milk prices in Quebec, including trade and revenue pooling between P5 and Western Milk Pool (WMP: British Columbia, Alberta, Saskatchewan and Manitoba) member provinces. Dairy imports from the United States, Europe and New Zealand impact Canada’s domestic milk production and can also affect farm gate prices. Regarding revenue pooling, I expect that it has a marginal impact on farm gate prices although it should help smooth them out. My models implicitly account for trade and revenue pooling, and several other issues not discussed.

I plan on further refine the models and to update the forecasts occasionally. I hope eventually to extend the models to forecast farm gate dairy prices in other provinces.